Deloitte Touche Tohmatsu India LLP (DTTILLP) recently conducted a survey on Income Tax digitalisation in India 2023. The Objective of survey was to Understand the industry’s outlook on various technology initiatives of the Central Board of Direct Taxes/Income Tax Department.

Here are key findings from the survey (Source)

92 percent of businesses with a turnover of more than INR 6,400 crore have significantly increased the usage of tax technology

79 percent of the survey respondents believe that their internal tax functions will be driven by technology in the next five years

Large organisations spend more time on compliance: The results indicate there is a direct relationship between the size of companies and the time that tax teams spend on compliance; relatively smaller organisations typically spend less time. Tax teams in large, complex organisations, despite their enhanced use of technology in tax, still spend a high proportion (around 70 percent on average) on tax compliance. For example, a big challenge faced by large organisations is TDS compliance. Given the significant amount of data involved, the reconciliation of TDS data and processing/re-processing of data requires large teams to focus full-time only on TDS compliance; in light of the fact that more transactions are coming within the purview of TDS, the problem is growing in complexity. On the flip side, i.e., where organisations are receiving income and TDS is deducted from such income, given the volumes involved and the revisions of TDS returns by payers, larger organisations deploy large teams on a full-time basis, specifically for the reconciliation of 26AS data.

Now, let’s look at the findings shared by another market leader Gartner

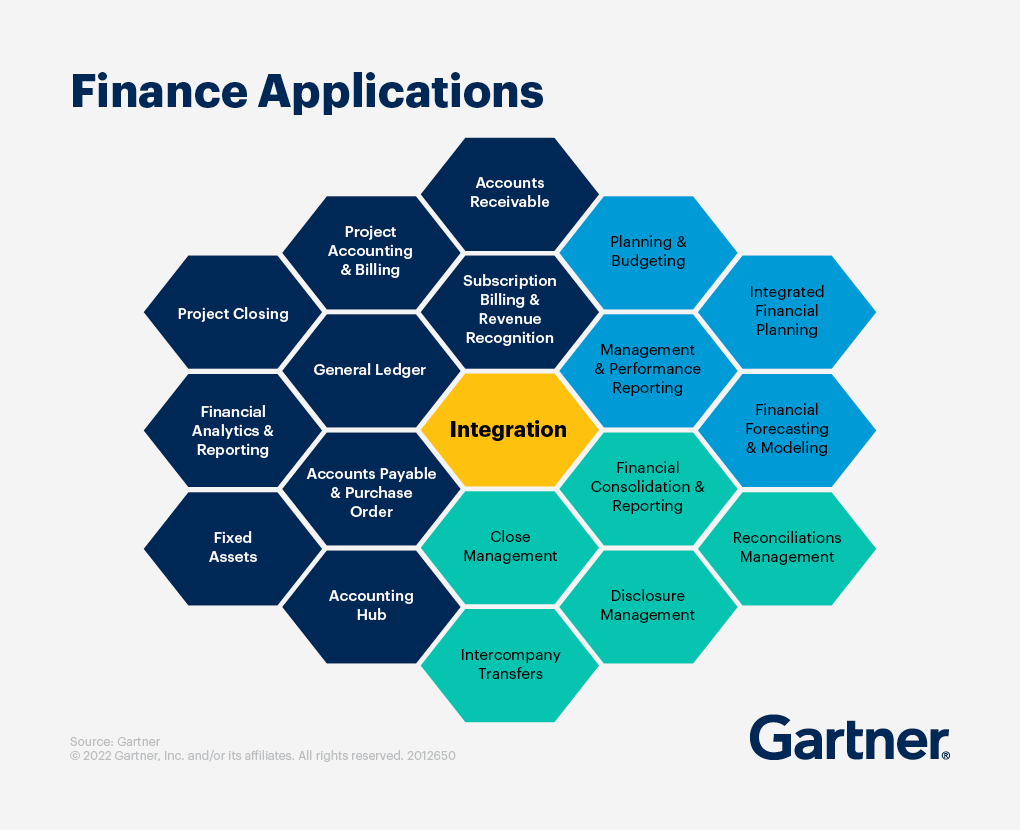

The ideal finance function technology portfolio is modular, allowing finance team users to acquire, assemble and configure different application capabilities in personalized ways that facilitate their work. Through 2024, 50% of financial application leaders will incorporate a composable financial management system approach. (Source)

Picture below shows the applications a finance function would have in future rather than just having billing management and compliances software. Reconciliation management is one of the building blocks of finance function and it is important to allow finance teams to spend more time on analysing the data rather than putting the data in spread sheets.

With insights shared by two market leaders, it is evident that every organization (big or small) has got it’s roadmap in place to adopt tax technology for finance transformation.

The market trends are changing and so are the expectations of new age CFO’s and next generation analysts. How a future tax function should operate, please click to read more

With cross assessment of data (Direct tax and Indirect tax), companies cannot manage the large amount of data manually for every financial year. Maintaining a data repository is must for companies to explain the numbers arrived YoY basis in case of a faceless assessment.

Initially companies implemented return filing tools as a reactive approach to Government’s push for technology-based compliances. But now companies want to catch up with government in terms of technology adoption. This can only be done by being proactive and implementing software which can automate activities which have to be finished before return filing such as TDS Reconciliations.

With business growth, data increases every year and it is not wise for any company to spend time of their qualified people on managing data manually. Adoption of technology can help companies in

- Managing their compliances effectively by avoiding risks which are inherent when processes are done manually

- Positioning themselves as a company of future and attracting best talent from market